Enjoy your retirement.

Let us handle your finances.

Fee-only financial planning to help you spend less on taxes and more on memories.

Retirement Income Planning

Planning for retirement can be confusing. We’ll help you figure out which accounts to use, when to start pensions or social security, and how to make sure you won’t run out of money. We’ll make your dollars work smarter so you can focus on maximizing life.

Professional Investment Management

With investing, the only goal that matters is yours. We aim to help you maximize your after-tax spendable dollar by focusing on the things you can control such as costs, taxation, and diversification.

Tax Preparation

Your wealth isn’t what you make, it’s what you keep. We’ll plan to help you pay less in taxes now and in the future and handle your tax return so you have more time and money to do what you love.

Do you have enough money to retire?

So many retirees feel the stress about having enough money to stay retired. Oftentimes it’s your spouse who handled the finances and now that responsibility falls on you.You may need some help from a local financial advisor in Knoxville to minimize the taxes you pay, and to put your hard earned retirement funds to work for you so you can ensure that you can stay retired.

Why Work With Us

With no commissions, we only do what is in your best interest

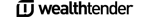

We are your guides through complexity to help your journey feel elegantly simple. We keep up with the latest research and trends in financial planning, and we apply them to your unique situation. We’ve removed conflict of interests to position ourselves as educators, not salesmen.

Maximize your after-tax spendable dollars

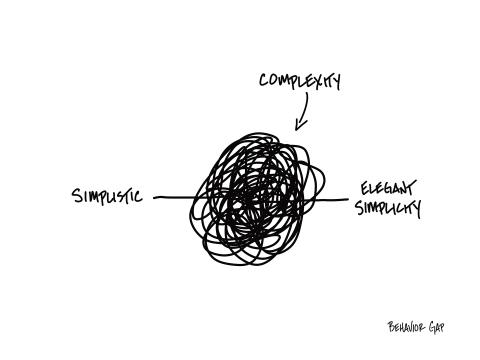

Real financial planning is the intersection of life and money. We want to help you maximize your after-tax spendable dollar, so you have more time and money for the things that matter most. That is how you maximize life.

Get a proven plan to retire stress free

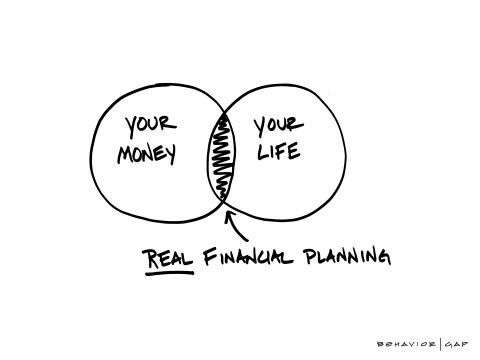

It begins with you making good life decisions for you and your family, then we plan how to make it happen tax efficiently. We’ve built a proactive system to stay on top of your planning needs by following an annual service calendar, so you’ll know what to expect from us and when.

How It Works

1

Book A Free Consultation Call

We’ll have a quick conversation to see if we’re a good fit to work together.

2

We’ll put your money to work for you

We’ll create an investment and tax plan to ensure you can stay retired.

3

You relax and enjoy your retirement

You can spend time worrying about your pickleball serve instead of worrying about finances.

Schedule a call and let’s create a plan for your retirement.

Schedule a date and time for your free consultation call.

Why book a call with Thomas Cook?

Hello! I'm Thomas Cook.

My passion for financial planning was ignited by witnessing my parents struggle with debt heading into their retirement. Seeing how money stress carried over into other aspects of life, such as health, sleep, and relationships, has driven me to learn everything about money.

As a CERTIFIED FINANCIAL PLANNER® and Enrolled Agent for the IRS, I've dedicated my career to helping retirees navigate stressful money decisions and financial uncertainty. Investment News has recognized me as one of the top wealth advisors in the USA under 40. I am also an Adjunct Lecturer of Personal Finance at the University of Tennessee - Knoxville.

So, if you're tired of being stressed about money and need a real plan to make sure you can retire with financial peace, you're in the right place.